Asia Pacific Investment Volume Falls 42% but Outlook Positive

Asia Pacific investment volume fell 42% q-o-q to US$11.6 billion (THB 362.9 billion) in Q1 2012, according to the latest Asia Pacific Capital Markets MarketView report published by CBRE, the leading global real estate services firm. Despite subdued sentiment this quarter, investment volume is expected to increase in the coming months, given continued investor interest in non-core assets and an easing lending environment.

Overall, the slow start to the year was driven in part by New Year holidays in January and the high investment volume witnessed in 2H 2011 which removed several assets from the market. The only market to buck the downward trend was Hong Kong, where investment volume surged 100% q-o-q thanks to the improved lending environment. All other markets across Asia Pacific saw a decrease in investment volume.

Asia Pacific investment volume fell 42% q-o-q to US$11.6 billion (THB 362.9 billion) in Q1 2012, according to the latest Asia Pacific Capital Markets MarketView report published by CBRE, the leading global real estate services firm. Despite subdued sentiment this quarter, investment volume is expected to increase in the coming months, given continued investor interest in non-core assets and an easing lending environment.

Overall, the slow start to the year was driven in part by New Year holidays in January and the high investment volume witnessed in 2H 2011 which removed several assets from the market. The only market to buck the downward trend was Hong Kong, where investment volume surged 100% q-o-q thanks to the improved lending environment. All other markets across Asia Pacific saw a decrease in investment volume.

According to Mr. James Pitchon, Executive Director and head of CBRE Research, Thailand, “Thailand continued to steadily recover from the floods and local private investors displayed a renewed interest in acquiring income producing assets. The period also saw a Singapore-based property fund acquiring an office building in Bangkok. Residential developers of low-rise housing have focussed on new land acquisition in areas that were not flooded.”

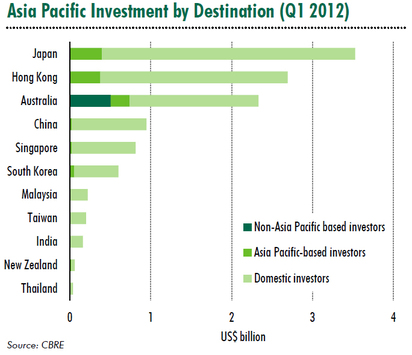

Domestic capital continued to drive the market, while cross border acquisitions declined. Domestic capital during Q1 2012 accounted for nearly 86% of the total investment volume. Deals completed by Asia REITs, domestic private investors and end-users comprised 55% of total investment turnover, up from 44% recorded in Q4 2011. On the other hand, cross-border acquisitions continued to slide in Q1, falling 69% q-o-q to US$1.6 billion (THB 50 billion) and accounting for just 14% of the total investment volume during the period.

Investors continued to shift their focus away from core office assets on account of the slowing leasing market, lack of quality product for sale and more attractive yields available in other sectors. Investment volume for office assets was just half of that recorded in Q4 2011, while volume in the retail sector was stable, down just 4% q-o-q. Demand for this product is anticipated to increase as domestic consumption grows and international retailers expand across the region.

Demand from local investors should remain firm in the near future, as evidenced by robust interest for retail and logistics assets. This—combined with the tight lending environment beginning to ease as central banks across the region adjust monetary policy—will likely have a positive effect on the market.

The tight lending environment in Asia Pacific began to alleviate in Q1 2012 as a number of central banks across the region adjusted monetary policy. The Bank of Thailand maintained the policy rate at 3.00% to support a smooth recovery of economic activity to normal levels while keeping inflation within target.

“Activity is expected to pick up over the coming months. Domestic capital will continue to account for the bulk of transactions as institutional investors, particularly the larger international groups, remain cautious about the global outlook. Investors will continue to shift their focus away from core office assets to other sectors where more attractive yields are available,” said Dr. Nick Axford, Executive Director and Head of CBRE Research, Asia Pacific.

Mr. Greg Penn, Executive Director, CBRE Investment Properties, Asia commented: “The lending environment improved in Q1 2012 and the trend is likely to continue. The further easing of inflation will provide extra room for interest rate cuts, a move which could rejuvenate buying activity as investors are given access to lower borrowing rates. Many developers in India and China continue to face liquidity challenges. And this will provide opportunities for investors to provide capital and acquire asset portfolios.”

Note : US$ 1 = THB 31.29

ฺcredit : CBRE Thailand

Domestic capital continued to drive the market, while cross border acquisitions declined. Domestic capital during Q1 2012 accounted for nearly 86% of the total investment volume. Deals completed by Asia REITs, domestic private investors and end-users comprised 55% of total investment turnover, up from 44% recorded in Q4 2011. On the other hand, cross-border acquisitions continued to slide in Q1, falling 69% q-o-q to US$1.6 billion (THB 50 billion) and accounting for just 14% of the total investment volume during the period.

Investors continued to shift their focus away from core office assets on account of the slowing leasing market, lack of quality product for sale and more attractive yields available in other sectors. Investment volume for office assets was just half of that recorded in Q4 2011, while volume in the retail sector was stable, down just 4% q-o-q. Demand for this product is anticipated to increase as domestic consumption grows and international retailers expand across the region.

Demand from local investors should remain firm in the near future, as evidenced by robust interest for retail and logistics assets. This—combined with the tight lending environment beginning to ease as central banks across the region adjust monetary policy—will likely have a positive effect on the market.

The tight lending environment in Asia Pacific began to alleviate in Q1 2012 as a number of central banks across the region adjusted monetary policy. The Bank of Thailand maintained the policy rate at 3.00% to support a smooth recovery of economic activity to normal levels while keeping inflation within target.

“Activity is expected to pick up over the coming months. Domestic capital will continue to account for the bulk of transactions as institutional investors, particularly the larger international groups, remain cautious about the global outlook. Investors will continue to shift their focus away from core office assets to other sectors where more attractive yields are available,” said Dr. Nick Axford, Executive Director and Head of CBRE Research, Asia Pacific.

Mr. Greg Penn, Executive Director, CBRE Investment Properties, Asia commented: “The lending environment improved in Q1 2012 and the trend is likely to continue. The further easing of inflation will provide extra room for interest rate cuts, a move which could rejuvenate buying activity as investors are given access to lower borrowing rates. Many developers in India and China continue to face liquidity challenges. And this will provide opportunities for investors to provide capital and acquire asset portfolios.”

Note : US$ 1 = THB 31.29

ฺcredit : CBRE Thailand

RSS Feed

RSS Feed