The local currency return for Asian commercial property investment was 8.4 per cent in 2011, reported the IPD Pan Asia Return Research (PARR).

Year-on-year, this was an improvement than the rate of 6.6 per cent in 2010.

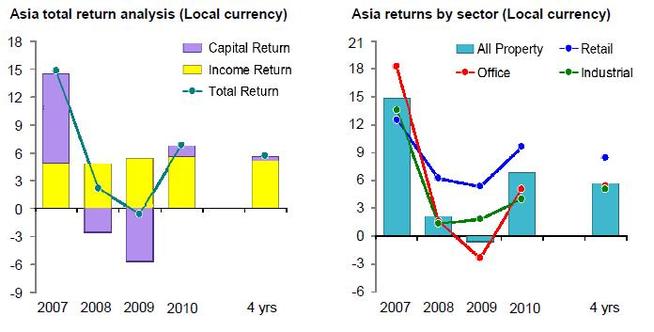

The Pan Asia 2011 return combines an income return of 5.6 per cent with a capital growth of 2.7 per cent.

IPD have conducted their largest sample of Asia investment property, to date. Research was sponsored by Invesco Real Estate and J P Morgan and included China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, and Thailand. The largest sample of Asia investment property and includes assets worth US$244.3 billion – a growth of 20 per cent, year-on-year.

Year-on-year, this was an improvement than the rate of 6.6 per cent in 2010.

The Pan Asia 2011 return combines an income return of 5.6 per cent with a capital growth of 2.7 per cent.

IPD have conducted their largest sample of Asia investment property, to date. Research was sponsored by Invesco Real Estate and J P Morgan and included China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, and Thailand. The largest sample of Asia investment property and includes assets worth US$244.3 billion – a growth of 20 per cent, year-on-year.

The annual research increases transparency, promotes better governance, and aids improvements in best practices across local property markets throughout Asia.

Dr Kevin Swaddle, managing director of IPD Asia said: “While most of Asia’s property investment markets improved a little last year, the Chinese markets soared with a return of 18 per cent. Still, there was a wide range of returns included in the 2011 Pan Asia composite, from a high of 22.3 per cent for Hong Kong to 3.4 per cent for Japan. The continuing poor performance in Japanese property, the largest segment of the index, will be of little surprise to investors.

“Some of the markets are up on last year, and a few down. But the key finding is that the top three markets are all influenced by China: Hong Kong, the Mainland itself and Taiwan.”

Thomas Au, director, head of Asia Real Estate Research at Invesco Real Estate Asia said: “The solid performance reflects strong fundamentals of the APAC market. The wide range of returns across different markets and sectors suggest that there are many different opportunities available for investors in this region.”

Presently, Asia returns yield higher than those in Europe.

“Values in Asia, and their continuing growth, are in doubt, but the previously stable income holds of Europe offer little better risk aversion potential. The US is still seeing strong double-digit returns, but this is not expected to continue next year. In the current global market it is becoming more and more difficult to find safe havens,” said Dr Swaddle. The weighted local currency Pan Asia return, over the previous five years was 6.2 per cent per year – combining an annual income return of 5.3 per cent and an annual capital return of 0.9 per cent.

Hong Kong rated consistently top with an annualised return of 16 per cent, per year. Japan had the lowest return at 1.6 per cent, per year. Both countries have occupied the top and bottom positions, over two, three and four years annualised.

Significantly ahead of office returns, retail property had an annualised return of 8.5 per cent over the five-year span. Office returns achieved 5.9 per cent.

David Chen, managing director, Head of Global Real Assets – Asia at J.P. Morgan Asset Management said: “The data illustrates why we believe the property markets offer attractive opportunities to harness the growth in Asia.”

The research will be announced throughout global events in: Tokyo, Seoul, London, Shanghai, Hong Kong, Kuala Lumpur, and Singapore.

by Property Report

Dr Kevin Swaddle, managing director of IPD Asia said: “While most of Asia’s property investment markets improved a little last year, the Chinese markets soared with a return of 18 per cent. Still, there was a wide range of returns included in the 2011 Pan Asia composite, from a high of 22.3 per cent for Hong Kong to 3.4 per cent for Japan. The continuing poor performance in Japanese property, the largest segment of the index, will be of little surprise to investors.

“Some of the markets are up on last year, and a few down. But the key finding is that the top three markets are all influenced by China: Hong Kong, the Mainland itself and Taiwan.”

Thomas Au, director, head of Asia Real Estate Research at Invesco Real Estate Asia said: “The solid performance reflects strong fundamentals of the APAC market. The wide range of returns across different markets and sectors suggest that there are many different opportunities available for investors in this region.”

Presently, Asia returns yield higher than those in Europe.

“Values in Asia, and their continuing growth, are in doubt, but the previously stable income holds of Europe offer little better risk aversion potential. The US is still seeing strong double-digit returns, but this is not expected to continue next year. In the current global market it is becoming more and more difficult to find safe havens,” said Dr Swaddle. The weighted local currency Pan Asia return, over the previous five years was 6.2 per cent per year – combining an annual income return of 5.3 per cent and an annual capital return of 0.9 per cent.

Hong Kong rated consistently top with an annualised return of 16 per cent, per year. Japan had the lowest return at 1.6 per cent, per year. Both countries have occupied the top and bottom positions, over two, three and four years annualised.

Significantly ahead of office returns, retail property had an annualised return of 8.5 per cent over the five-year span. Office returns achieved 5.9 per cent.

David Chen, managing director, Head of Global Real Assets – Asia at J.P. Morgan Asset Management said: “The data illustrates why we believe the property markets offer attractive opportunities to harness the growth in Asia.”

The research will be announced throughout global events in: Tokyo, Seoul, London, Shanghai, Hong Kong, Kuala Lumpur, and Singapore.

by Property Report

RSS Feed

RSS Feed