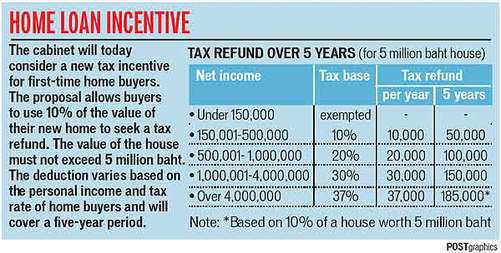

The Finance Ministry will table a tax cut scheme for first-time home buyers to the cabinet for approval Tuesday offering a maximum 10% tax deduction on houses costing up to 5 million baht.

The 5 million baht ceiling is changed from the previous 3 million to help cover buyers of property in urban areas, Finance Minister Thirachai Phuvanatnaranubala said yesterday.

The ministry will also propose that the money people spend on buying houses be used as tax deductions to calculate taxable income, he said.

The move comes hot on the heels of the Yingluck Shinawatra cabinet on Tuesday approving a tax rebate scheme worth 30 billion baht to support first-time car buyers.

It is estimated there will be a discount of about 60,000 to 100,000 baht on the current price of a car with an engine size no larger than 1,500cc and on all pickup trucks. Car sales are expected to be boosted by about 500,000.

Issara Boonyoung, president of Housing Business Association, said the government's first-time home incentives would not encourage low-income earners as the tax deduction of a maximum of 10% of the housing price would only benefit middle- to high-income earners.

People earning around 4 million baht a year would get the maximum benefit. Those buying units costing 5 million baht needed to earn a salary of 100,000 baht a month.

"This group does not consist of lower-income earners," he said.

Lower-income earners who could afford to buy a home for one million baht would be those earning 15,000 baht a month. But these buyers would not benefit from the income tax deduction as they did not need to pay income tax in the first place.

Mr Issara said if only new homes would benefit from the incentives, then developers selling housing units priced at less than 5 million baht would enjoy the biggest benefits.

"If the government wants to encourage people to buy a residential unit, it should support lower-income earners," he said.

Pumipat Sinacharoen, deputy chief finance officer of Asian Property Development, said the tax incentives would help boost the housing market.

"If the incentives are given only to new housing units and do not cover resale houses, it is understood that new units create more of a multiplier effects on the economy than second-hand homes do."

Government Housing Bank president Worawit Chailimpamontri said the Finance Ministry had not yet announced a policy for the GHB to launch a scheme to offer zero-interest home loans for first-time home buyers for five years. But the bank is implementing a programme to offer interest-free home loans for first-time home buyers that was initiated by the previous Abhisit Vejjajiva government.

The Abhisit government had already implemented policies to support first-time homebuyers to some extent through the GHB's programme which offers a 30-year mortgage with a two-year interest-free loan for properties valued at less than 3 million baht.

Of the applications for the two-year-interest-free loans totalling about 25 billion baht, about 17 billion baht worth of loans has already been approved by the bank, Mr Worawit said.

"It is now clear that the [Pheu Thai] government will not go ahead with the zero-interest home loan programme so there is no need for home buyers to wait for it," Mr Worawit said, adding that the government is expected to support buyers via tax cuts or tax breaks.

However, Mr Worawit said the GHB will continue with its programme which offers one-year interest-free home loans.

Mr Worawit said that competition in the home loan market among commercial banks this year is not as fierce as last year, partly because of soaring interest rates, although demand for first properties remained strong.

He expected the home mortgage situation next year would be no different from this year as concerns over interest rates and flood problems would be key factors affecting buyers' decisions.

Bangkok Post 20/09/2011

The 5 million baht ceiling is changed from the previous 3 million to help cover buyers of property in urban areas, Finance Minister Thirachai Phuvanatnaranubala said yesterday.

The ministry will also propose that the money people spend on buying houses be used as tax deductions to calculate taxable income, he said.

The move comes hot on the heels of the Yingluck Shinawatra cabinet on Tuesday approving a tax rebate scheme worth 30 billion baht to support first-time car buyers.

It is estimated there will be a discount of about 60,000 to 100,000 baht on the current price of a car with an engine size no larger than 1,500cc and on all pickup trucks. Car sales are expected to be boosted by about 500,000.

Issara Boonyoung, president of Housing Business Association, said the government's first-time home incentives would not encourage low-income earners as the tax deduction of a maximum of 10% of the housing price would only benefit middle- to high-income earners.

People earning around 4 million baht a year would get the maximum benefit. Those buying units costing 5 million baht needed to earn a salary of 100,000 baht a month.

"This group does not consist of lower-income earners," he said.

Lower-income earners who could afford to buy a home for one million baht would be those earning 15,000 baht a month. But these buyers would not benefit from the income tax deduction as they did not need to pay income tax in the first place.

Mr Issara said if only new homes would benefit from the incentives, then developers selling housing units priced at less than 5 million baht would enjoy the biggest benefits.

"If the government wants to encourage people to buy a residential unit, it should support lower-income earners," he said.

Pumipat Sinacharoen, deputy chief finance officer of Asian Property Development, said the tax incentives would help boost the housing market.

"If the incentives are given only to new housing units and do not cover resale houses, it is understood that new units create more of a multiplier effects on the economy than second-hand homes do."

Government Housing Bank president Worawit Chailimpamontri said the Finance Ministry had not yet announced a policy for the GHB to launch a scheme to offer zero-interest home loans for first-time home buyers for five years. But the bank is implementing a programme to offer interest-free home loans for first-time home buyers that was initiated by the previous Abhisit Vejjajiva government.

The Abhisit government had already implemented policies to support first-time homebuyers to some extent through the GHB's programme which offers a 30-year mortgage with a two-year interest-free loan for properties valued at less than 3 million baht.

Of the applications for the two-year-interest-free loans totalling about 25 billion baht, about 17 billion baht worth of loans has already been approved by the bank, Mr Worawit said.

"It is now clear that the [Pheu Thai] government will not go ahead with the zero-interest home loan programme so there is no need for home buyers to wait for it," Mr Worawit said, adding that the government is expected to support buyers via tax cuts or tax breaks.

However, Mr Worawit said the GHB will continue with its programme which offers one-year interest-free home loans.

Mr Worawit said that competition in the home loan market among commercial banks this year is not as fierce as last year, partly because of soaring interest rates, although demand for first properties remained strong.

He expected the home mortgage situation next year would be no different from this year as concerns over interest rates and flood problems would be key factors affecting buyers' decisions.

Bangkok Post 20/09/2011

RSS Feed

RSS Feed