Dubai superseded London and Jakarta to become the world’s top performing real estate market, in the first quarter of this year.

Dubai recorded a 4 per cent rise in the period between December last year and March this year, according to Knight Frank Prime Global Cities Index. This placed Dubai ahead of London at 2.7 per cent and Jakarta at 3.3 per cent.

Dubai recorded a 4 per cent rise in the period between December last year and March this year, according to Knight Frank Prime Global Cities Index. This placed Dubai ahead of London at 2.7 per cent and Jakarta at 3.3 per cent.

Knight Frank summarised that Dubai’s residential property prices rose 2.7 per cent since last September and 0.3 per cent over the past 12 months.

Dubai villa sales increased 3 per cent in the first quarter of this year, compared to a peak in the third quarter of 2008 – but prices still remain 25 per cent lower, commented Jones Lang La Selle in its quarterly Dubai real estate market overview.

Dubai property prices rocketed after the city opened its real estate sector to foreign investors in 2002.

Emirates apartment sales also saw stability in the first quarter of this year. However, market prices remain low: down 34 per cent compared to the third quarter of 2008, according to Jones Lang LaSalle.

Real estate prices in Dubai rallied almost 80 per cent from the start of 2007 to mid-2008.

Home prices in Dubai suffered the biggest reversal seen in the Gulf property market as a result of the financial crisis; where prices declined by 60 per cent on average.

Annually, the index rose 1.4 per cent. Such figures offered optimism across the market, although the Eurozone’s debt debacle remained at the forefront of the global economic agenda. The crucial elections of Russia, France and Greece also add to instability across the market. Moreover, Asia’s highly-effective cooling measures show no signs of ease.

Amidst the uncertainty, some luxury buyers took to the observatory side-lines, said Knight Frank.

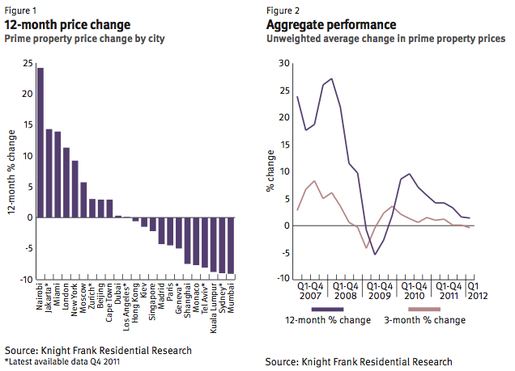

Over the year period, Nairobi was the strongest performing prime global city with an increase of 24.2 per cent. Jakarta, London, and Miami all reported double figure increases in property prices.

Nicholas Halt, Knight Frank’s Asia-Pacific research director summarised that the overall index is likely to remain subdued in 2012, fluctuating between marginal price falls and rises, according to Arabian Business.

He said: “It seems unlikely we are on the cusp of a new deflationary cycle in luxury global house prices.”

By Property Report

Dubai villa sales increased 3 per cent in the first quarter of this year, compared to a peak in the third quarter of 2008 – but prices still remain 25 per cent lower, commented Jones Lang La Selle in its quarterly Dubai real estate market overview.

Dubai property prices rocketed after the city opened its real estate sector to foreign investors in 2002.

Emirates apartment sales also saw stability in the first quarter of this year. However, market prices remain low: down 34 per cent compared to the third quarter of 2008, according to Jones Lang LaSalle.

Real estate prices in Dubai rallied almost 80 per cent from the start of 2007 to mid-2008.

Home prices in Dubai suffered the biggest reversal seen in the Gulf property market as a result of the financial crisis; where prices declined by 60 per cent on average.

Annually, the index rose 1.4 per cent. Such figures offered optimism across the market, although the Eurozone’s debt debacle remained at the forefront of the global economic agenda. The crucial elections of Russia, France and Greece also add to instability across the market. Moreover, Asia’s highly-effective cooling measures show no signs of ease.

Amidst the uncertainty, some luxury buyers took to the observatory side-lines, said Knight Frank.

Over the year period, Nairobi was the strongest performing prime global city with an increase of 24.2 per cent. Jakarta, London, and Miami all reported double figure increases in property prices.

Nicholas Halt, Knight Frank’s Asia-Pacific research director summarised that the overall index is likely to remain subdued in 2012, fluctuating between marginal price falls and rises, according to Arabian Business.

He said: “It seems unlikely we are on the cusp of a new deflationary cycle in luxury global house prices.”

By Property Report

RSS Feed

RSS Feed